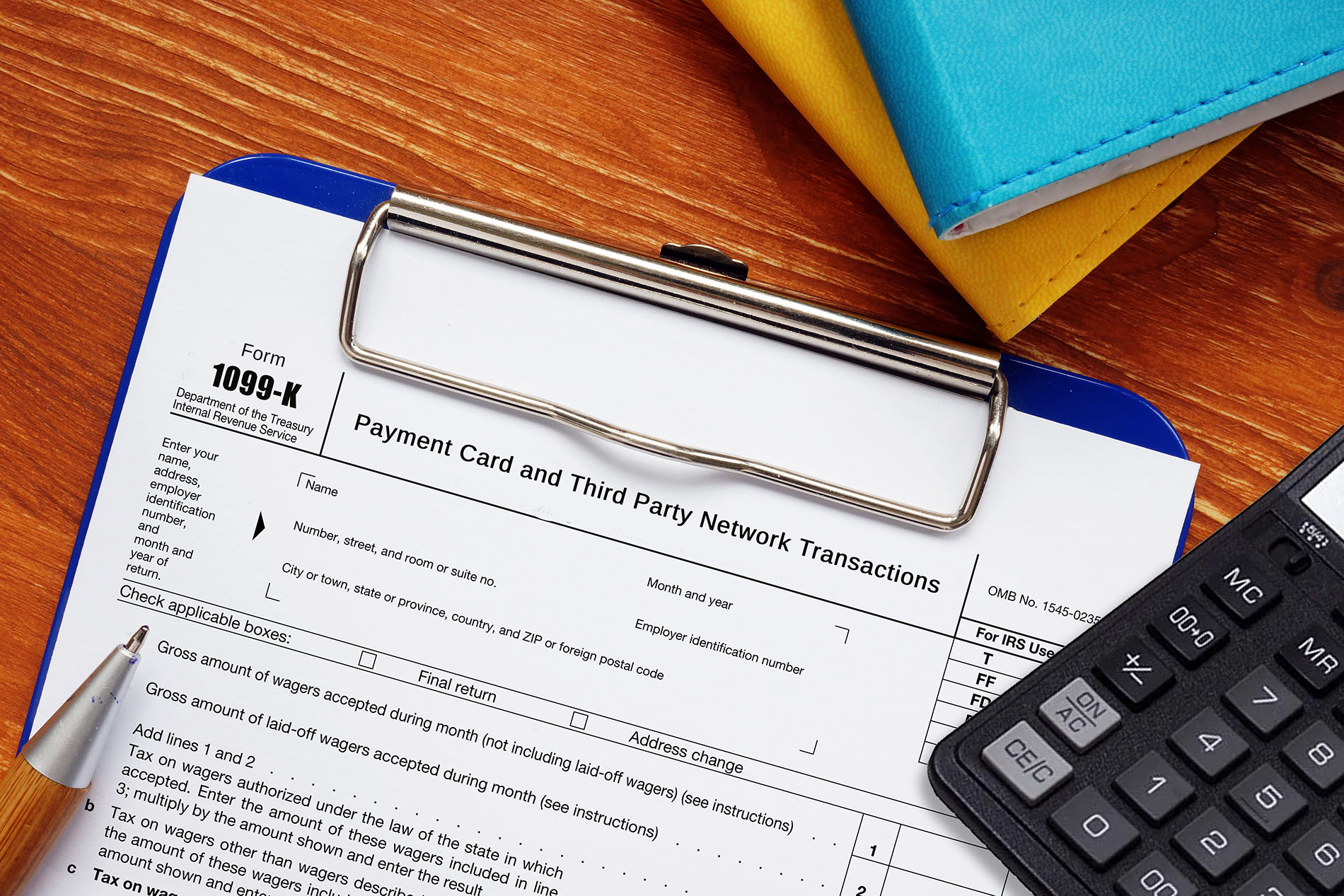

Filing Your 2023 Freelance Taxes? Take Note of These Inflation Reduction Act Adjustments to the Standard Deduction

With the April 15 tax deadline just a few weeks away you should be aware of some adjustments to the standard deduction thresholds. Keep in