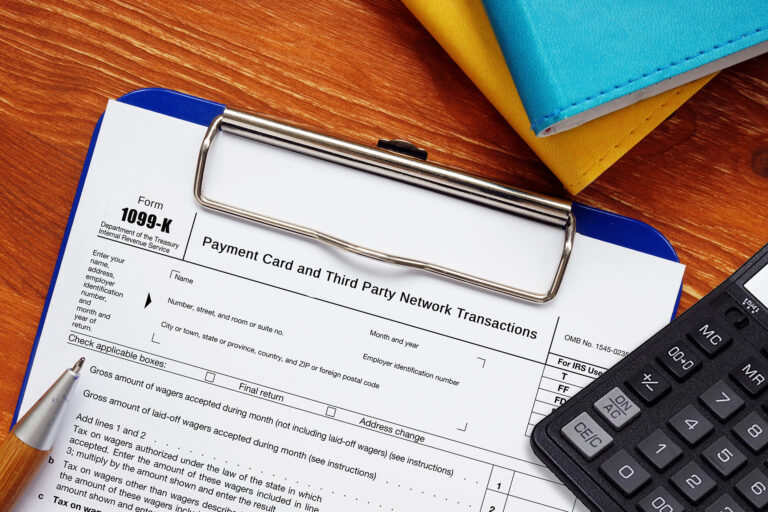

Filing Your 2023 Freelance Taxes? Take Note of These Inflation Reduction Act Adjustments to the Standard Deduction

With the April 15 tax deadline just a few weeks away you should be aware of some adjustments to the standard deduction thresholds. Keep in mind that the standard deduction is in addition to any eligible freelance tax deductions that…